Imagine a young man from the Philippines who works tirelessly on a construction site in Saudi Arabia, sending a portion of his earnings back to his family. That money helps pay for his siblings' school fees, mother's medication, and the family’s basic needs.

This scenario is not unique.

In 2023, global remittance flows to low- and middle-income countries reached an estimated $656 billion. These funds are not just lifelines for families but vital contributors to national economies.

In this article, we'll take a closer look at remittance and the role Phantom plays in global money movements.

What are remittances?

Remittances are financial transfers sent by individuals working abroad to their families or communities in their home countries. Traditionally, remittances were sent through banks and money transfer services such as Western Union and MoneyGram. However, the rise of digital and crypto wallets has disrupted the conventional process, offering faster and more cost-effective solutions.

The global scale of remittances

According to World Bank data, remittances to low- and middle-income countries surpassed $656 billion in 2023.

Key remittance corridors, such as US-Mexico and Gulf States-South Asia account for a significant portion of these flows. For instance, workers in Gulf States, such as the UAE and Saudi Arabia, send billions annually to their home countries of India, Pakistan, and Bangladesh.

Generally, however, India, China, and the Philippines rank among the largest remittance recipients.

Economic significance of remittances

Impact on individuals

For millions of families, remittances are a lifeline. They improve living standards by covering basic needs like food, clothing, and utilities. Beyond the essentials, remittances also enable access to better education, healthcare, and housing.

Remittances also serve as a form of financial security during crises. Whether it's a natural disaster, economic downturn, or personal emergency, these funds can help families weather the storm.

Impact on national economies

At a macroeconomic level, remittances contribute significantly to the GDP of many countries. For instance, Mexico's remittances exceed revenues from oil exports, in Sri Lanka remittances are greater than the value of the tea trade, and Egypt's remittances are worth more than its income from the Suez Canal.

Remittances also play a crucial role in stabilizing foreign exchange reserves. By increasing the inflow of foreign currency, they help countries manage their trade deficits and maintain currency stability. This is especially critical for developing nations that rely heavily on imports.

Challenges in remittance transfers

Despite their benefits, remittance transfers face several challenges.

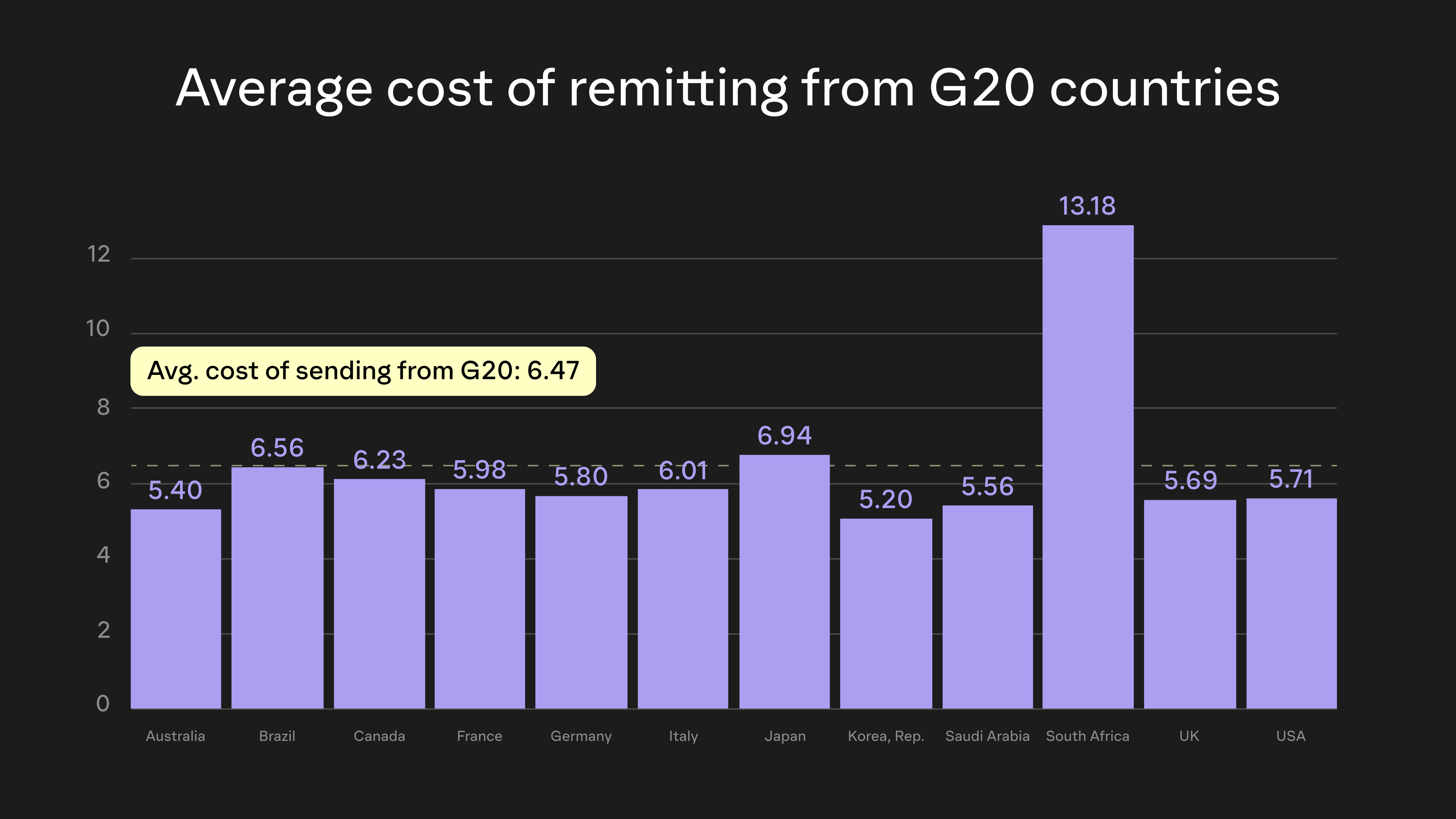

- Transaction fees: The cost of sending remittances remains a significant burden. On average, sending $200 costs about 6% in fees. These fees disproportionately affect low-income families who rely on every dollar.

- Accessibility issues: Many remittance recipients live in remote or underserved areas with limited access to conventional banking infrastructure. This lack of accessibility forces them to rely on informal channels, which are often less secure and more expensive.

- Fraud and exploitation: **Remittance transfers are vulnerable to fraud and exploitation. Scams, hidden fees, and unreliable service providers can erode the value of transfers, leaving recipients with less than they were promised.

- Regulatory barriers: Stringent anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, while necessary, can create obstacles for remittance providers and users. These regulations often lead to delays and additional costs, discouraging formal remittance channels.

As remittances are more than just financial transactions—they are lifelines that sustain millions of families and bolster national economies—the goal has to be to make them more efficient, secure, and inclusive—which is exactly what we’re working on at Phantom.

Low-cost and secure remittances with Phantom

Anyone with a smartphone and an Internet connection can effortlessly set up a Phantom wallet, and receive and send stablecoins, such as USDC and USDT, alongside cryptocurrencies such as BTC, ETH, and SOL—instantly, securely, and for less than a penny.

This efficiency far surpasses the limitations of conventional remittance services, which are often burdened by the challenges outlined above.

Simply put: Phantom democratizes access to financial tools, making it possible for anyone, anywhere, to send and receive money quickly, cost-effectively, and securely—paving the way for a more inclusive and accessible global financial ecosystem.

Sending remittances to family and friends with Phantom

- First, download Phantom. Then, create a new wallet.

- Ensure your Phantom wallet has at least 0.1 SOL to cover transaction fees (refer to the steps below to purchase SOL).

- Log in to your mobile app or browser extension.

- Click the "Buy" tile, select the token you'd like to purchase (e.g. SOL or USDT/C), and complete the purchasing process.

- Once your purchase is complete, return to the home screen and click the "Send" tile. Choose the token you want to send, enter the recipient's Solana address, and finalize the sending transaction.

- After completing the sending process, the recipient will receive the tokens in their Phantom wallet within seconds—avoiding high fees, opaque processes, and frustrating delays.

Receiving remittances from family and friends with Phantom

- Download Phantom and set up a new wallet.

- Make sure your you hold at least 0.1 SOL to cover transaction fees (see instructions above to purchase SOL).

- Share your Solana wallet address with family and friends via the "Receive" tile on your Phantom wallet’s home screen.

- Once you receive remittances in SOL or USDT/C, send those tokens to your account on a centralized exchange—e.g. Binance, Bybit, Bitget, OKX, or Upbit—via your Solana address.

- On the centralized exchange, swap SOL or USDT/C to USD or your local currency, then withdraw the money to your bank account for daily needs.

- It's cheap, secure, hassle-free, and avoids the complications of Western Union, MoneyGram, and similar services.

How to bridge tokens to Solana with Phantom?

If you’d like to bridge funds to Solana for low-cost, near-instant remittances, use our very own Crosschain Swapper. With our Crosschain Swapper, you can bridge tokens across Solana, Ethereum, Base, and Polygon right in your Phantom wallet.

Disclaimer: This guide is strictly for educational purposes only and doesn’t constitute financial or legal advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.