Imagine owning a fraction of a high-rise building in New York or a share of a US Treasury bond with just a few clicks. This is the promise of tokenized real-world assets (RWAs).

By converting tangible and intangible assets into digital tokens on a blockchain, tokenization is unlocking unprecedented opportunities for liquidity, accessibility, and transparency.

As this transformative asset class gains momentum, it’s set to redefine global finance, bridging traditional systems with the decentralized future and democratizing access to wealth-building opportunities like never before.

Read on to discover more about the tokenization of real-world assets (RWAs) and how to trade tokenized RWAs using Phantom!

What are tokenized real-world assets (RWAs)?

The tokenization of real-world assets (RWA) refers to the process of converting tangible or intangible assets into digital tokens that exist on a blockchain such as Solana.

These tokens represent ownership, rights, or access to the underlying assets, which can include physical items such as real estate and commodities, as well as financial instruments such as fiat currencies, US Treasuries, and private credit.

Why are tokenized RWAs becoming increasingly popular?

Historically, many asset classes have been accessible only to institutional investors and high-net-worth individuals due to high entry barriers.

The tokenization of RWAs is changing this dynamic by democratizing access to these exclusive markets. Blockchain technology enables retail investors to participate in previously inaccessible asset classes by lowering the minimum investment threshold by leveraging fractionalization.

Fractional ownership means that instead of needing significant capital to buy a house or gain exposure to private credit, an individual can invest as little as a few dollars. This democratization is especially impactful in emerging markets, where smaller investors now have access to global opportunities.

Essentially, by breaking down financial barriers, tokenization is fostering a more inclusive global financial ecosystem.

How do tokenized RWAs work in crypto?

One of the most transformative aspects of tokenizing RWAs is the improvement in liquidity for traditionally illiquid assets. Real estate, commodities, and financial instruments have long been considered difficult to trade due to their indivisible nature and high transaction costs.

Blockchain technology, however, enables fractional ownership, allowing assets to be divided into smaller units that can be traded seamlessly on decentralized platforms.

Additionally, liquidity pools in decentralized finance (DeFi) provide mechanisms for ensuring that these tokenized assets remain liquid. This enhanced liquidity not only benefits investors by providing exit opportunities but also drives greater capital efficiency.

Tokenized RWAs bridge traditional finance and DeFi

RWAs play a critical role in connecting traditional finance (TradFi) with decentralized finance (DeFi), creating a hybrid financial system that combines the best of both worlds. By tokenizing assets, traditional financial instruments can be integrated into DeFi platforms, offering greater utility and flexibility.

For example, tokenized US Treasuries can be used as collateral on DeFi lending platforms, allowing investors to borrow stablecoins or other digital assets. This integration benefits both sectors: DeFi gains the stability and predictability of traditional assets, while TradFi benefits from blockchain’s efficiency.

The ability to collateralize real-world assets in DeFi protocols also drives innovation in financial services. Borrowers in emerging markets, for instance, can use tokenized farmland as collateral for loans, bypassing traditional banking systems and unlocking new sources of capital.

Tokenized RWAs increase transparency and prevent fraud

Blockchain technology inherently offers transparency and immutability, which are crucial for reducing fraud and building trust in asset ownership and transactions. Consequently, tokenized RWAs provide an auditable record of ownership that is tamper-proof and accessible to all participants in the network.

In industries such as real estate, where disputes over title ownership are common, tokenization ensures that the history of an asset is clear and verifiable. Similarly, in supply chain financing, tokenized commodities can be tracked from origin to delivery, reducing the risk of counterfeit goods or fraudulent claims.

This level of transparency not only enhances trust among investors but also attracts institutional participation. By leveraging blockchain’s capabilities, tokenized RWAs, therefore, address some of the long-standing vulnerabilities in traditional asset management.

Tokenized RWAs: Navigating a complex regulatory landscape

While the benefits of tokenizing RWAs are clear, the journey is not without challenges.

One of the main challenges is aligning blockchain practices with existing legal frameworks, which were initially designed for traditional financial systems. Questions around custody, taxation, and investor protection remain critical issues for regulators and industry participants alike. For instance, determining the jurisdiction of a tokenized asset traded on a global blockchain network can be complex.

Having said that, efforts are underway to create clear regulatory guidelines for tokenized RWAs. For example, frameworks such as the European Union’s Markets in Crypto-Assets (MiCA) regulation aim to provide clarity on how digital assets, including tokenized RWAs, should be managed and traded.

As such, collaboration between regulators and industry stakeholders will be crucial to unlocking the full potential of tokenized real-world assets going forward.

What lies ahead for tokenized real-world assets?

The market for tokenized RWAs is poised for exponential growth in the coming years, driven by advancements in technology and increasing institutional adoption. Innovations in asset tokenization are likely to expand to new sectors, including renewable energy credits, intellectual property, and even human capital through tokenized work agreements.

DeFi protocols are expected to play a larger role in managing tokenized RWAs, creating sophisticated financial instruments such as yield-generating portfolios that combine both traditional and digital assets.

Additionally, the rise of decentralized autonomous organizations (DAOs) could lead to community-driven investment models, where groups pool resources to acquire tokenized assets collectively.

As blockchain technology matures, interoperability between different blockchain networks will become critical for seamless asset transfers and management. Cross-chain solutions will enable tokenized assets to move freely across ecosystems, further enhancing liquidity and accessibility.

The tokenization of real-world assets is not just a trend, but a fundamental shift in how we perceive and interact with value. By combining the stability and familiarity of traditional assets with the innovation and efficiency of blockchain technology, tokenized RWAs will continue paving the way for a more inclusive, transparent, and efficient financial system.

Trading tokenized RWAs with Phantom

Phantom offers browser extensions for Firefox, Chrome, Brave, and Edge, as well as apps for iOS and Android to get started on Solana.

- First, download Phantom. Then, create a new wallet.

Once you do that, you're ready to go!

To fund your Phantom wallet, read our Apple Pay and Google Pay guide.

The most popular tokenized RWAs on Solana is USDY from Ondo. USDY is the world's first permissionless yield-bearing token secured by US Treasuries. USDY accrues yield daily, whether you're staking, borrowing, pledging, or just holding it.

Here's how you can buy USDY:

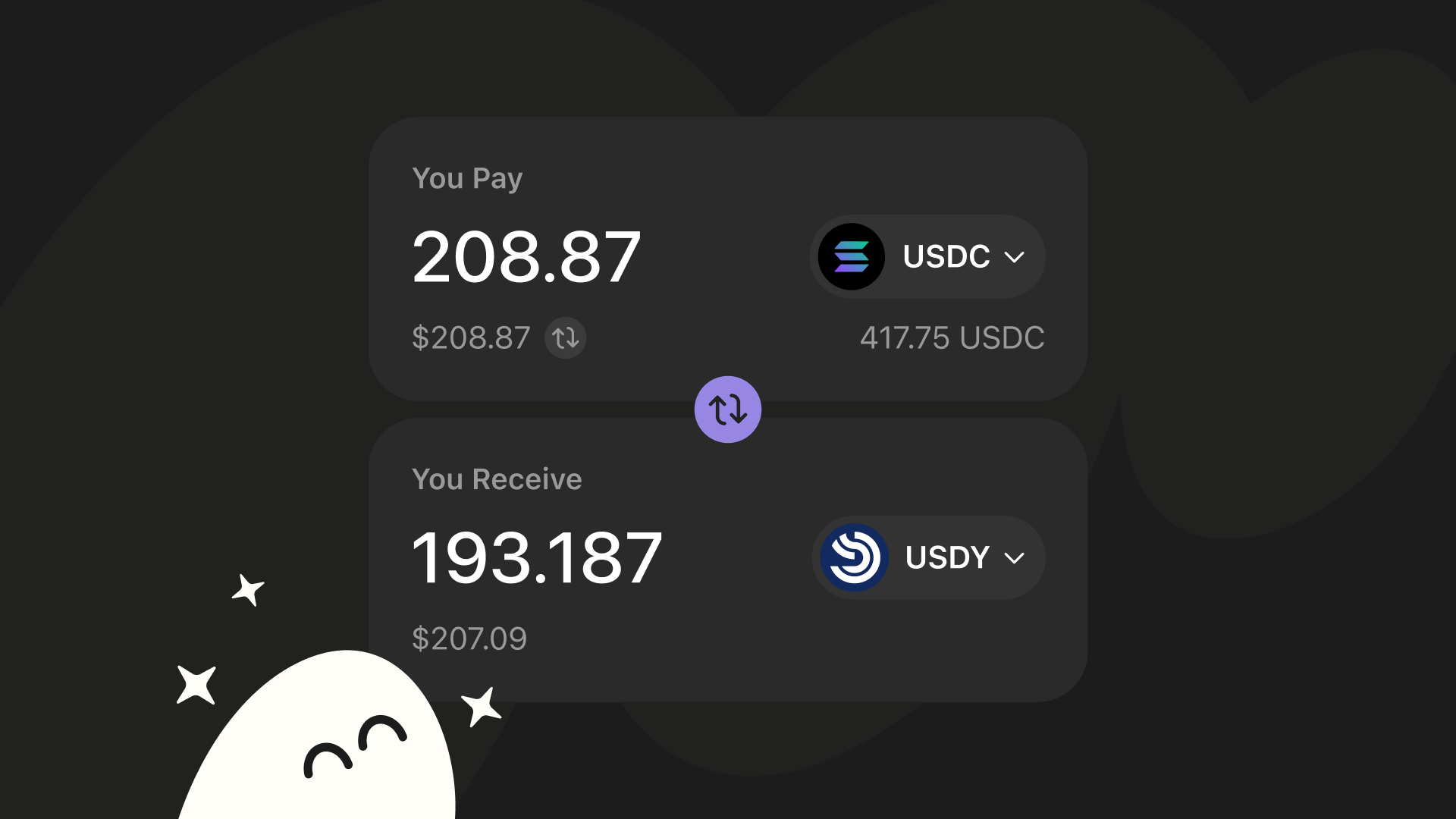

- Log in to your mobile app or browser extension

- Select "Swap" and choose the token you'd like to use in the swap

- Next, select the dropdown menu in the "You receive" section and type "USDY" into the search bar

- After selecting the USDY token, finalize your swap order and select "Review Order"

- Once you're done reviewing your order, agree to the terms of service

- You'll receive an order overview

- Select "Swap" to finalize your order

How to share USDY with friends and family

Know someone who might be interested in USDY? You can share a simple token page with them so they can get involved.

Here's how:

- Open Phantom

- Search for “USDY” and select the token

- Click the “Share” button

- Copy the link

- Send the link through your preferred app, such as iMessage, Telegram, Instagram, or others

When you share this link, the recipient will receive the official USDY token page from Phantom.

How to bridge tokens to Solana with Phantom?

If you’d like to bridge funds to Solana, use our very own Crosschain Swapper! With our Crosschain Swapper, you can bridge tokens across Solana, Ethereum, Base, and Sui right in your Phantom wallet.

FAQs

Disclaimer: This guide is strictly for educational purposes only and doesn’t constitute financial or legal advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.