Perpetual futures, or perps, are contracts that let you speculate on the price movements of an asset without needing to own the asset itself. This means that you can bet on whether they believe SOL or ETH will go up or down, without having to actually buy SOL or ETH.

Why do traders use perps?

Perpetual futures offer a number of distinct advantages compared to spot trading:

1. Speculate with more flexibility

Perpetual futures give you the ability to take advantage of both rising and falling markets, by either “going long” if you believe an asset will go up in price, or “going short” if you believe the opposite. This allows you to actively speculate on price movements independent of any underlying holdings.

2. Amplify potential returns (or losses) with leverage

You can use leverage, allowing you to control larger positions with less upfront capital and significantly amplify your gains (or losses). Leverage, however, can also create additional risks, such as liquidation, which is when your positions are closed out automatically to cover the losses on your trade. This can be avoided by always ensuring you have enough capital in your account to cover potential losses, or by setting stop loss orders.

3. Hedging

Perps can also serve as an important hedging tool, allowing you to minimize potential losses. For example, if you hold a large amount of SOL, and expect a short-term price decline, you could open up a short position on SOL perps to offset the potential losses from your spot position.

4. Enhanced liquidity

Perps trading volume typically far outpaces spot trading volume, which offers you deeper liquidity than in spot markets. This means you can enter and exit larger positions quickly, even during volatile market conditions, and you can also access assets that might have limited liquidity in spot markets, without needing to actually hold them.

How perps work

Perps mirror the spot price of an asset, which is the current market price an asset can be bought or sold. To keep prices aligned with the asset’s spot price, perps rely on a feature called the funding rate mechanism.

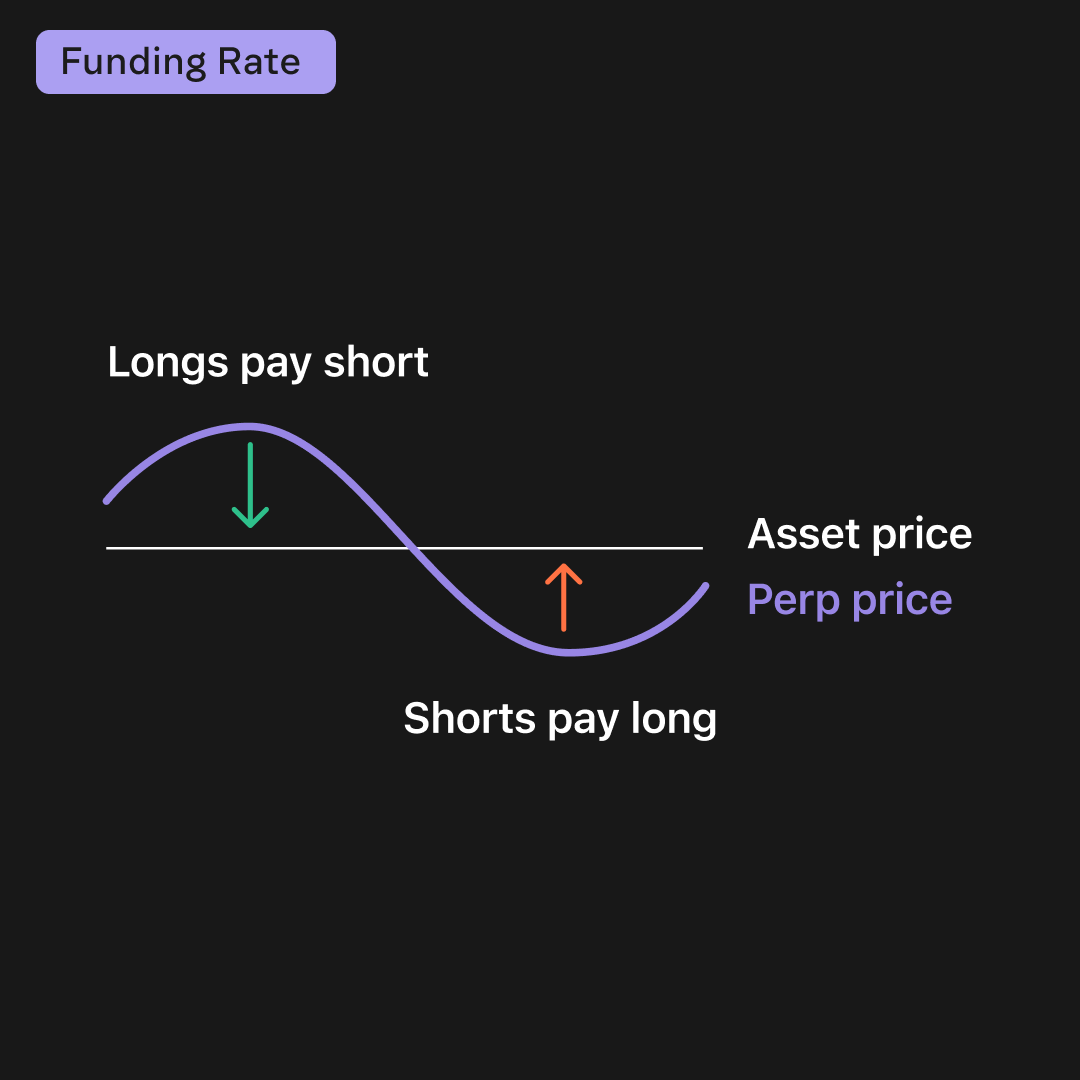

The funding rate is a small payment that traders on one side of the trade (long or short), pay to the traders on the other side. This fee incentivizes traders to keep demand balanced, and ensure that perpetual futures prices don’t deviate significantly from the spot price of the asset.

There are two main types of funding rates:

Positive funding rate: If perpetual futures are more expensive than an asset’s spot price, that means that there is more demand for long positions. So, traders who are holding long positions pay a funding fee to those with short positions.

Negative funding rate: If perps are cheaper than the asset’s spot price, that means there’s more demand for short positions. In this case, traders who are holding short positions pay a funding fee to those with long positions.

Always keep in mind: The more leverage you use, the higher in funding rate fees you’ll pay. And the longer you keep a position open, the more in funding rates you’ll pay, since they’re charged on a regular, periodic schedule.

What makes perps unique?

There are a few key features that separate perpetual futures from traditional futures.

No expiration date: It’s all in the name — you can hold perpetual futures in perpetuity, as long as you continue to pay the funding fees. Traditional futures, on the other hand, have daily, monthly, or quarterly expiration dates.

24/7 markets: Like the crypto spot market, perpetual futures trading is available any time, any day, allowing you to take advantage of volatility whenever it happens.

Leverage opportunities: Perps trading generally gives you access to higher levels of leverage, allowing you control larger positions with less capital. Traditional futures typically have lower levels of leverage.

Are perps more risky than spot trading?

Perps trading has its advantages compared to spot trading. You can go long or short, access deeper liquidity, and boost your returns using leverage.

But it's important to keep in mind that trading perps, especially when using leverage, can put you at higher risk to lose your funds.

There are three main risks to keep in mind when trading perps:

Liquidation

When trading with leverage, there’s always the potential of being “liquidated” from your position. This is when the asset price moves too far against your position, and your position is automatically closed. The more leverage you’re using, the less flexibility you have. If you’re going long on BTC with 3x leverage, for example, an approximately 33% price decline on BTC would end up in your position being liquidated. But if you used 20x leverage, it would take just an approximately 5% decline to automatically close your position.

Funding rates

With perps, you’re required to pay funding rates in order to keep prices in line with the spot market. Since they’re paid on a regular basis (like hourly, or in 8-hour intervals), the longer you hold a position, the more you’ll pay in fees. And the more leverage you use, the higher the fees will be. For long-term, higher-leverage positions, these fees can add up and reduce your profitability.

Volatility

Crypto markets can be volatile. Quick price swings create profit opportunities, but can also increase your risk of losses, especially when using leverage. You should always use risk management strategies like stop loss orders and set take profit levels to help minimize your risk from sharp price rises or declines.

How to get started trading perps

You can start trading perps in Phantom with just a few taps.

Once you've funded your perps balance, all you have to do is:

- Pick a market

- Decide if you want to go long or go short

- Choose an amount to trade and leverage

- Set your take profit and stop loss levels

- Review trade details and open your position

Note: Phantom Perps aren't available everywhere. Trading perps involves significant risk and may not be suitable for all users. This post is not intended for UK audiences.