Crypto doesn’t always go up, and sometimes the best move is knowing how to protect yourself when things head south.

That’s where shorting steps in.

Shorting isn’t about rooting against your favorite tokens—it’s about staying prepared in a market that moves fast and unpredictably.

In this guide, we’ll walk through the basics of shorting and explore the following:

- How to short Bitcoin (BTC)

- How to short Ethereum (ETH)

- How to short Solana (SOL)

- How to short memecoins

Now, let’s get into it!

Shorting crypto with perpetual futures (Phantom and Hyperliquid)

Perpetual futures contracts are a popular method for shorting cryptocurrencies.

To short crypto using perpetual futures, you enter a sell (short) position on the contract, betting that the price of the underlying asset will decrease. If the price drops, you can close your position—pocketing the difference as profit. Also, with perpetual futures you have ample time to wait for the perfect position to exit, as these contracts don't have an expiration date, enabling you to hold your positions indefinitely—unlike traditional futures.

That said, most perpetual futures platforms are built with advanced features that can be tricky to navigate. Phantom keeps things simple with an intuitive, mobile-first design that lets you open, close, and manage perpetual futures positions directly from your wallet—powered by Hyperliquid. No extra apps, no complicated interfaces—just fast, straightforward trading with full control at your fingertips.

If you’re ready to short BTC, ETH, SOL, or memecoins such as PEPE, BONK, TRUMP, PENGU, or FARTCOIN with Phantom Perps, follow the steps below.

How to set up Phantom on mobile

- Follow the installation steps of the Phantom app on your device

- Open the app—you’ll be greeted by the Phantom onboarding screen

- Select “Create New Wallet”

- Enable biometric security and click “Next”. This secures your wallet using fingerprint or facial recognition to ensure you are the only one that can access it. We strongly recommend turning this feature on!

- You will be presented with your “Secret Recovery Phrase” (seed phrase)

- Be sure to store your Secret Recovery Phrase in a safe and secure location!

- Your Secret Recovery Phrase is the MOST important part of your new wallet:

- Whoever has access to your Secret Recovery Phrase will have access to the wallet’s funds

- If you lose your Secret Recovery Phrase, you will lose access to your wallet and its funds

- We at Phantom never have access to your Secret Recovery Phrase

- Phantom team members will never ask you for your Secret Recovery Phrase

- The Secret Recovery Phrase is the only way to recover your wallet

- After saving your wallet password and securing your Secret Recovery Phrase, select “Continue” to proceed

- You can enable notifications to get instant updates about your wallet activity. These can also be customized in the Phantom app via Settings > Notifications

- To fund your wallet, make sure to check out our Apple Pay and Google Pay guide

How to set up Phantom on desktop

- Follow the steps in your respective extension store to add Phantom to your browser

- Open the Phantom browser extension and select “Create New Wallet”

- Key in a secure password and select “Continue”

- You will be presented with your “Secret Recovery Phrase” (seed phrase)

- Be sure to store your Secret Recovery Phrase in a safe and secure location!

- Your Secret Recovery Phrase is the MOST important part of your new wallet:

- Whoever has access to your Secret Recovery Phrase will have access to the wallet’s funds

- If you lose your Secret Recovery Phrase, you will lose access to your wallet and its funds

- We at Phantom never have access to your Secret Recovery Phrase

- Phantom team members will never ask you for your Secret Recovery Phrase

- The Secret Recovery Phrase is the only way to recover your wallet

- After saving your wallet password and securing your Secret Recovery Phrase, select “Continue” to proceed

- After successfully setting up your Phantom wallet, you can access it on the top right-hand side of your browser's toolbar

- Don’t see Phantom? Click the icon that looks like a puzzle piece to access a list of your browser’s extensions, where you will find Phantom

- Click on the pin icon next to Phantom to make the wallet visible in your browser's toolbar and easier to find in the future

- To fund your wallet, make sure to check out our Apple Pay and Google Pay guide

Shorting crypto with perpetual futures (Jupiter and Drift)

Platforms such as Jupiter and Drift also let you short crypto with perpetual futures, but they’re more like advanced trading terminals with a ton of tools and pro-level charts. This is great for seasoned traders, but a bit complex for first-timers compared to Phantom’s more intuitive approach discussed above.

Shorting crypto on lending and borrowing platforms (Save)

Another method to short crypto involves using lending and borrowing protocols such as Save.

Here's how it works:

- First, you deposit collateral into the protocol and then borrow the cryptocurrency you believe will decrease in value.

- Then, you immediately sell the borrowed asset at the current market price.

- If the price drops as anticipated, you buy back the same amount of the asset at the lower price.

- Finally, you return the borrowed asset to the protocol, keeping the difference as profit.

Choosing the right trading platform

When selecting a platform for shorting among Phantom, Jupiter, Drift, and Save, carefully evaluate the following key aspects:

- User interface: Assess the platform's ease of use and intuitiveness.

- Asset diversity: Check the variety of tokens available for shorting.

- Fee structures: Compare transaction costs and any additional charges.

- Security measures: Verify recent security audits (look for up-to-date reports or request them from the team if not readily available).

Also, make sure that you explicitly understand the risks of shorting cryptocurrencies—which we’ll continue to discuss below.

Risks of shorting crypto

Shorting cryptocurrencies is inherently risky due to the volatile nature of the crypto market.

Prices can move rapidly, and unexpected events—such as regulatory changes or technological developments—can cause significant price swings.

Here’s what to keep an eye out for:

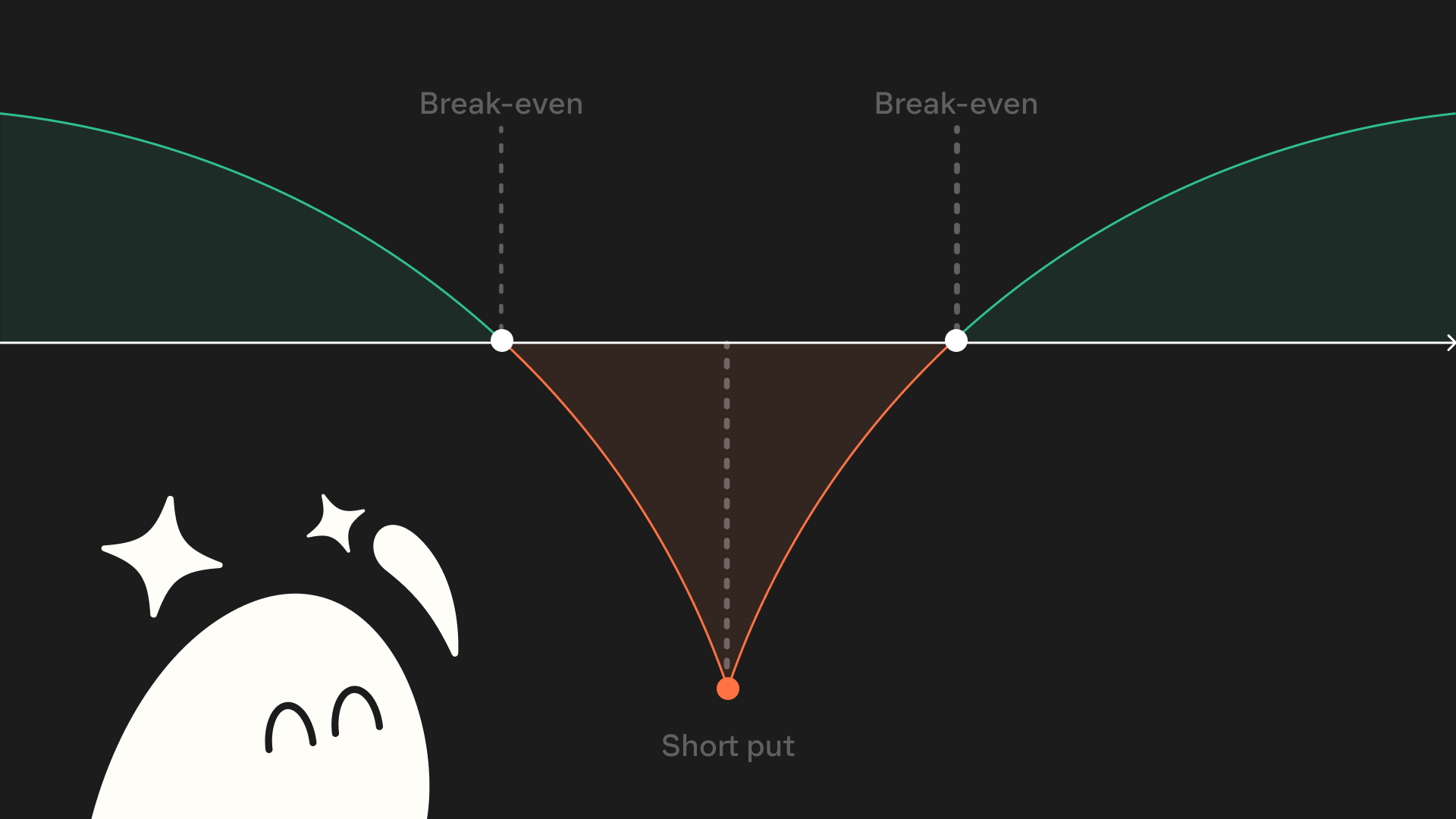

- Unlimited losses: Unlike buying an asset (where your maximum loss is the amount you invested), shorting potentially exposes you to unlimited losses—meaning you could lose your entire collateral. Mostly, this is the case on decentralized exchanges (DEXs) such as Hyperliquid, Jupiter, and Drift, as they rely on perpetual futures.

- Margin calls: If you’re using leverage to short, the platform may issue a margin call if the market moves against you. This means you’ll need to add more collateral to maintain your position. If you can’t meet the margin requirement, your position may be liquidated, resulting in a loss.

- Market manipulation: The crypto market is still relatively young and can be susceptible to manipulation. Whales (large holders of cryptocurrency) can influence prices, leading to sudden spikes or drops that may not reflect the asset’s true value.

- Liquidity risks: In thinly-traded markets, it can be difficult to find buyers or sellers, leading to slippage (the difference between the expected price and the actual execution price). This can erode your profits and increase your losses.

Apart from this, it’s also crucial to bear in mind the legal and regulatory environment in your region before shorting cryptocurrencies.

Legal and regulatory considerations

The legal and regulatory landscape for shorting cryptocurrencies varies significantly across different jurisdictions. In some countries, shorting crypto is entirely legal, while in others, it may be restricted or subject to specific regulations.

- Some jurisdictions regulate the platforms that offer short selling of cryptocurrencies. This can include requirements for licensing, reporting, and customer protection. Ensure that the platform you choose complies with local regulations.

- Shorting cryptocurrencies may have tax implications, such as capital gains tax. The tax treatment of profits and losses from shorting can vary, so it’s essential to understand the tax rules in your country and keep accurate records of your trades.

- Engaging in short selling on unregulated or decentralized platforms may expose you to legal risks. If a platform is shut down or if there are disputes, you may have limited recourse to recover your funds.

FAQs

Disclaimer: This guide is strictly for educational purposes only and doesn’t constitute financial or legal advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.