Market conditions are constantly evolving. Skilled traders recognize that opportunities exist in both upward and downward trends—but they also understand that each comes with its own set of significant risks.

Learn how shorting works and how it can help you manage risk in different market conditions.

Understanding market movements

In layman’s terms: Shorting allows traders to take positions that may profit from price declines.

Even the strongest rallies take breaks. Prices dip, consolidate, or move sideways. It’s how markets breathe. Instead of sitting on the sidelines, shorting lets you trade the downside, turning red days into potential green ones.

What “shorting” really means

Normally, you profit when prices go up. With a short, you profit when they go down.

For example:

- You short an asset at $100.

- It drops to $90.

- You make $10 on the move down.

That’s the basic concept of shorting. You take a position that benefits if the price decreases. However, if the price increases instead, you will incur losses.

“Do I own the token?”

Nope, when you short, you’re not buying the token itself. You’re opening a contract that mirrors its price. These contracts are called perpetual futures, or “perps” for short.

Perpetual futures are derivative contracts, A.K.A. - financial instruments whose value is derived from an underlying asset. Unlike traditional futures, they have no expiration date.

This is where the term derivative comes from: you earn value from the real asset (like ETH), without ever holding the asset itself. However, it is important to note, you are exposed to the full price risk (both gains and losses) of the underlying asset, magnified by any leverage used.

Some key terms to know

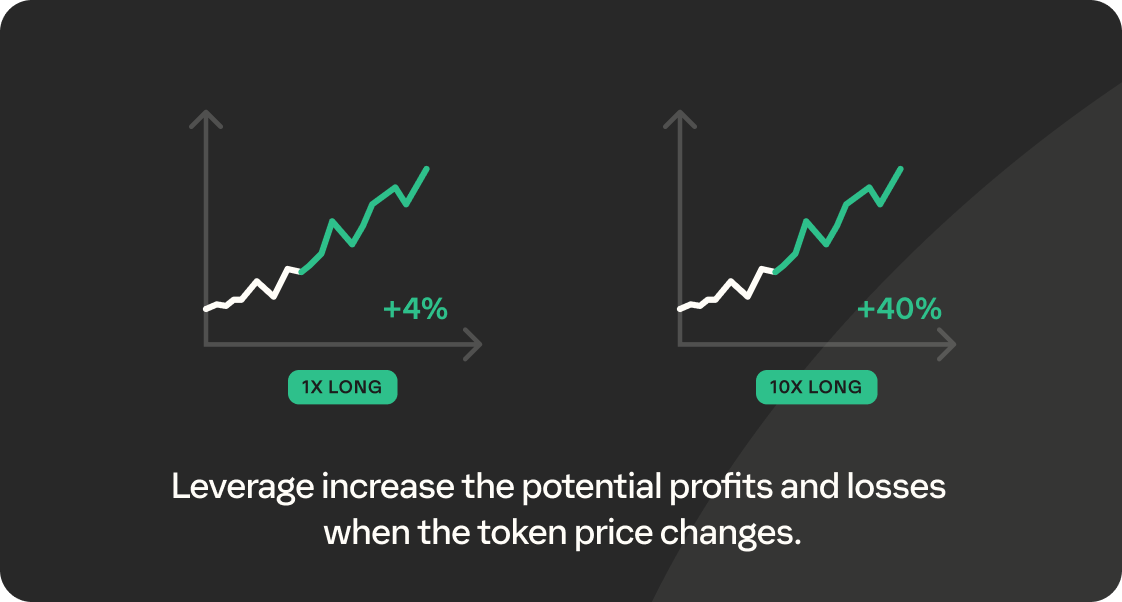

Leverage: Lets you amplify your position using borrowed funds.For example:

- 2x leverage: a 1% move becomes 2%.

- 5x leverage: a 1% move becomes 5%.

- 10x leverage: a 1% move becomes 10%.

This applies to both gains and losses. A 10% adverse move with 10x leverage means a 100% loss of your margin. Higher leverage increases the risk of liquidation.

Margin: The collateral you must deposit to open and maintain a leveraged position. If the market moves against your position and your margin falls below the maintenance requirement, your position will be liquidated automatically.

- For example: Open a $100 trade with 5x leverage and you only need $20 of your own funds. That $20 is your margin. If the position moves 20% against you, your entire $20 margin could be lost.

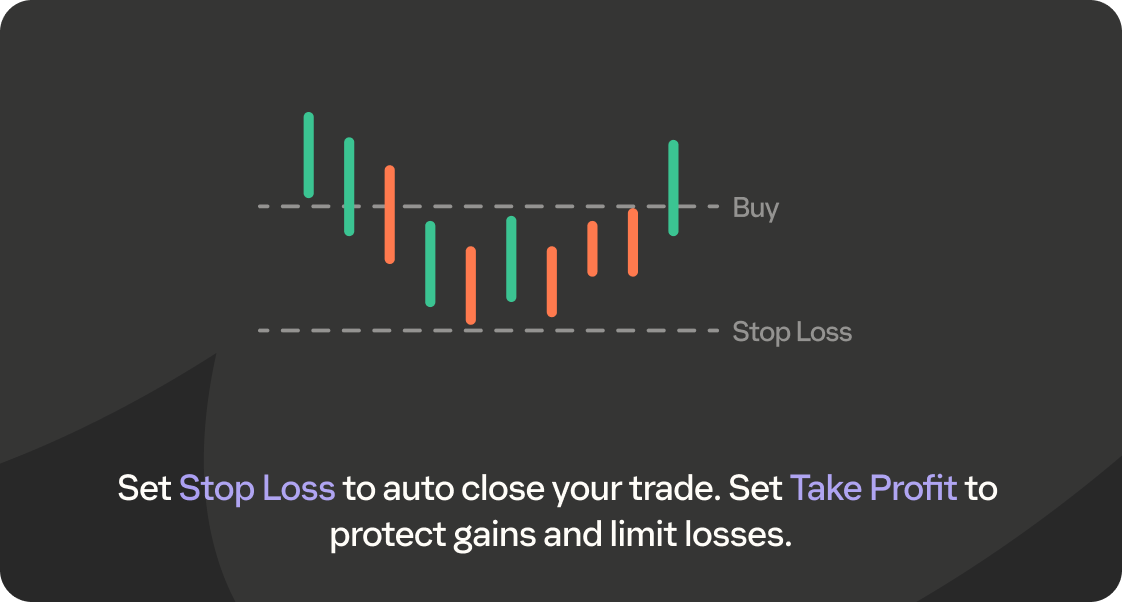

Stop Loss (SL): An automatic exit if the market moves against you. Helps cap your downside.

Take Profit (TP): Automatically closes your trade when your target is hit—locking in your gains.

Hedging: Think of it as your backup plan. If you’re holding ETH and expect turbulence, shorting ETH can offset some of that risk.

Liquidation: When your position is automatically closed because your margin has fallen too low. In other words, the market moved against you enough to erase your collateral and the system has closed the trade.

How to short in Phantom

- Choose an asset you think might dip.

- Set your leverage (lower leverage reduces liquidation risk but still carries significant loss potential).

- Strongly recommended: Set a stop loss to limit potential losses and a take profit to lock in gains. Note: Stop losses may not execute at your exact price during rapid market movements.

- Place your short in Phantom.

You can close your trade anytime, you’re in control from start to finish. Phantom makes it simple to set, adjust and manage your trades right in-wallet.

Understanding the risks

Shorting and leverage are powerful tools, but they cut both ways.

- Only trade with what you’re willing to lose.

- Consider incorporating strategies like hedging into your gameplan.

- Study market trends before entering a position.

- Consider whether leveraged trading is appropriate for your financial situation and risk tolerance.

While the concept of shorting may sound simple on paper, trading perpetual futures is complex and may require expert knowledge and careful risk management.

Even experienced traders experience losses. No trading strategy can eliminate risk. Perps trading is not suitable for all investors.

Learn more about perpetual futures

This article has provided a deeper dive to how shorting using perpetual futures work.

Before trading, ensure you understand:

- How leverage magnifies both gains and losses

- The mechanics and costs of funding rates

- How liquidation works

- The difference between spot trading and derivatives

If you decide this product is appropriate for you, consider reviewing the educational resources below to understand the mechanics in more detail.

Check out more resources on trading perps:

Note: This content is for educational purposes only and does not constitute investment advice or a recommendation to trade. Shorting and digital asset trading involve significant risk, including the possible loss of your entire investment. Past performance does not guarantee future results. Always do your own research and consider your financial situation before trading.